HiBT Trading Fees Comparison: Navigating the Best Choices in 2025

In the ever-evolving world of cryptocurrencies, choosing the right trading platform is crucial for every investor. With increasing concerns about

The Importance of Understanding Trading Fees

Before diving deep into the HiBT trading fees comparison, let’s explore why these fees are important. Think of trading fees as a bank vault charge for accessing your assets. Just like a bank charges fees for maintaining a vault, cryptocurrency exchanges charge fees for their services. Understanding these fees can lead to substantial savings.

Current Crypto Trading Fee Landscape

As of 2025, several platforms have emerged as prominent players in the Vietnamese market, where user growth rates have surpassed 30% annually. This rapid expansion demands that users be mindful of the different types of fees they may encounter, including:

ong>Trading Fees: ong> The standard fees incurred for making trades on a platform.ong>Withdrawal Fees: ong> Charges associated with moving your assets off the exchange.ong>Deposit Fees: ong> Potential costs linked to adding funds to your account.ong>Inactivity Fees: ong> Fees that occur if the account is dormant for an extended period.

HiBT Trading Fees Breakdown

Next, let’s break down HiBT trading fees in detail. HiBT is known for its user-friendly interface and competitive fee structure, which makes it appealing to both novice and seasoned traders.

Trading Fees Structure

HiBT adopts a tiered trading fees structure based on the user’s trading volume. The higher the volume, the lower the fee. Here’s a snapshot of what that looks like:

| Trading Volume (30 days) | Fee Percentage |

|---|---|

| 0 – $1,000 | 0.1% |

| $1,001 – $10,000 | 0.08% |

| $10,001 – $100,000 | 0.06% |

| Above $100,000 | 0.04% |

Withdrawal and Deposit Fees

Unlike some platforms that may impose hefty withdrawal fees, HiBT takes a more reasonable approach:

ong>Withdrawal Fee: ong> 0.0005 BTC (subject to market conditions).ong>Deposit Fee: ong> Free for bank transfers but variable for credit and debit card deposits.

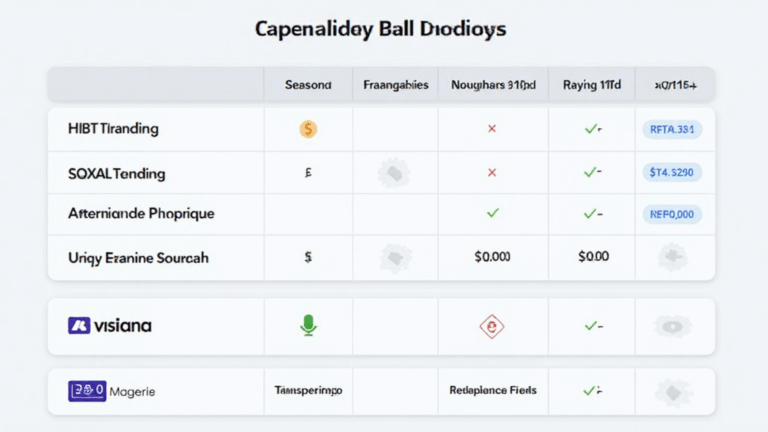

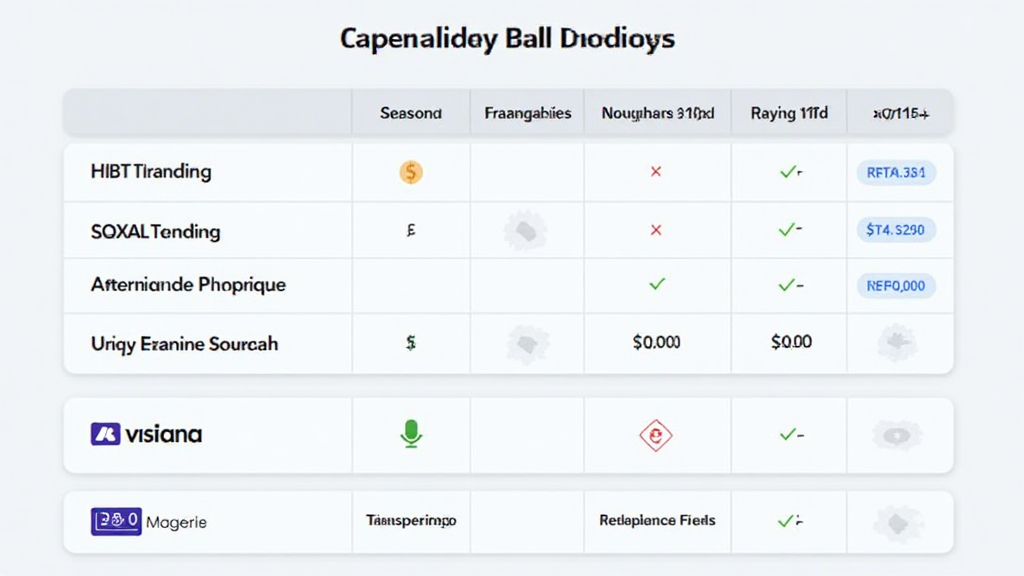

Comparing HiBT with Other Platforms

Now that we understand HiBT’s fee structure, how does it compare with other leading platforms? Let’s examine some comparisons.

Fee Comparisons with Competitors

Here’s a glimpse of how HiBT trades against competitors like Binance and Coinbase:

| Platform | Trading Fees | Withdrawal Fees |

|---|---|---|

| HiBT | 0.1% – 0.04% | 0.0005 BTC |

| Binance | 0.1% – 0.075% | 0.0005 BTC |

| Coinbase | 0.5% – 1.49% | Varies by network |

As you can see, while HiBT offers competitive trading fees, platforms like Binance may sometimes offer lower fees for high-volume traders. However, HiBT’s simple fee structure is appealing for those new to trading.

The Impact of Fees on Your Investment

Understanding trading fees can have a significant impact on overall investment returns. A common scenario often discussed is the long-term effects of trading fees on portfolio growth.

Case Study: Fee Impact Over Time

Let’s illustrate this with a simple example. Consider investing $10,000 over five years.

- With a 0.1% fee structure, you’d pay $10 annually.

- With a 1% fee structure, you’d pay $100 annually.

Over five years, the difference can yield substantial savings, showcasing that even small percentage differences lead to larger outcomes.

Local Markets and User Growth in Vietnam

The Vietnamese cryptocurrency market is growing rapidly, as previously noted, with user engagement steadily increasing. In a country where nearly 35% of the population is involved in online trading, platforms like HiBT capitalize on the trend by offering localized services and support.

Vietnam’s Crypto Landscape

This growth is not just limited to HiBT. The entire crypto ecosystem in Vietnam is blooming, drawing in new users from diverse sectors. As regulations begin to stabilize, more investors are entering the market.

Conclusion: Making an Informed Choice with HiBT

Choosing the right platform can pave the way for trading success. HiBT’s user-centric approach and transparent fee structure cater to both beginners and experienced traders. By understanding and comparing HiBT trading fees, you can make informed decisions that will optimize your trading experience.

As the cryptocurrency landscape continues to evolve, make sure you remain up-to-date with the latest trends, strategies, and regulations. Always consult financial advisors for personalized advice. In conclusion, in the competitive market of digital assets, HiBT is a noteworthy option to consider.