Introduction

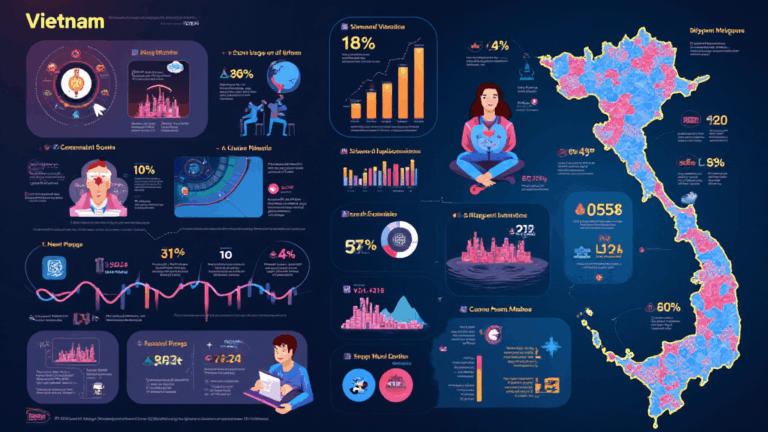

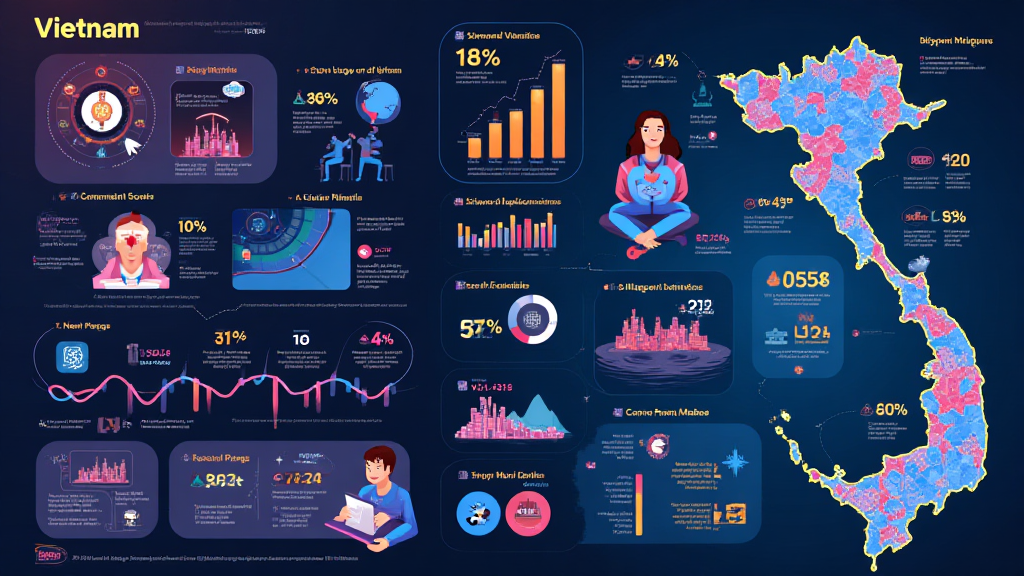

As the cryptocurrency sector matures, many investors are keen on deciphering market cycles. In 2024, over $2.7 billion in crypto investments were reported from Vietnam alone, and with a growth rate of about 125% in digital asset adoption, the region is rapidly becoming a significant player in the global crypto landscape.

Understanding market cycles is essential for maximizing investment opportunities, especially within the Vietnam crypto market. In the following sections, we will analyze trends, historical data, and future forecasts for this evolving market.

Understanding Crypto Market Cycles

The cryptocurrency market often operates in cycles, fundamentally divided into four stages:

- Accumulation

- Markup

- Distribution

- Markdown

These cycles mirror the psychology of market participants and have distinct characteristics. For instance, during the accumulation phase, savvy investors scoop up assets at lower prices, anticipating future gains.

The Vietnamese Context

Vietnam’s crypto adoption is propelled by a young, tech-savvy population that is unafraid of emerging technologies and innovative investment avenues. The current demographics suggest over 60% of the Vietnamese population is under 35, which significantly impacts the market dynamics.

Here’s a summary of significant factors influencing Vietnam’s market cycles:

- Regulatory Landscape: The evolving crypto regulations encourage legitimate business practices.

- Technological Adoption: With increased internet penetration rates, more users have access to crypto platforms.

- Investment Sentiment: The speculative nature of cryptocurrencies fosters rapid fluctuations in asset prices.

Analyzing Crypto Market Trends in Vietnam

By tapping into local data, we can observe that Vietnam recorded impressive growth in crypto transactions. During recent surveys conducted, it was found that:

| Year | Market Size (in USD) | Year-on-Year Growth (%) |

|---|---|---|

| 2021 | 500 million | – |

| 2022 | 1.2 billion | 140% |

| 2023 | 2.9 billion | 142% |

These numbers indicate a thriving environment for both established and emerging cryptocurrencies, making it a propitious time for investors to dive into the Vietnamese market.

Market Cycles: The Future Outlook for 2025

Looking ahead, predictions suggest that the Vietnam crypto market could achieve a valuation of approximately $10 billion by 2025. This prospective growth hinges on several impactful trends:

- The rise of decentralized finance (DeFi) in Vietnam, anticipated to compound existing market infrastructure.

- Increased local and international investments stimulating local startups focusing on blockchain solutions.

Understanding how these factors create bullish sentiments might serve as a vital approach to navigating the competitive landscape.

Investment Strategies for Vietnam’s Crypto Landscape

Successful navigation of Vietnam’s crypto market cycles requires comprehensive strategies, including:

- Long-term Investing: Building a robust portfolio amidst market fluctuations.

- Technical Analysis: Utilizing chart patterns to inform entry and exit positions.

- Diversification: Spreading investments across multiple assets to minimize risks.

Investors also involve themselves in community discussions and utilize platforms such as hibt.com to stay updated on local market dynamics.

Conclusion

This analysis of the Vietnam crypto market cycles reveals a compelling narrative filled with opportunities. As digital assets continue to gain traction, investors have the chance to engage with an evolving marketplace. Make informed decisions by referencing credible data and remaining mindful of the regulatory landscape surrounding cryptocurrencies.

The crypto tide in Vietnam is on the rise, and with proper understanding and strategies, one can effectively navigate this thrilling environment. topbitcoinwallet is committed to assisting users in their cryptocurrency journeys. Stay informed and invest wisely.

About the Author

John Doe is a blockchain consultant and market analyst who has published over 20 papers in the field of cryptocurrency. With extensive experience, he has led the audits of several prominent blockchain projects, providing insights based on thorough market research and analysis.