Vietnam Bitcoin Halving Impact Analysis: What You Need to Know

As the world of cryptocurrency continues to evolve, significant events such as Bitcoin halving have far-reaching implications. With the next halving event on the horizon, many investors are eagerly analyzing its potential impacts, especially in emerging markets like Vietnam. In 2024 alone, reports indicate that around $4.1 billion was lost due to DeFi hacks, highlighting the need for sound investments and a deeper understanding of the market dynamics. This article aims to provide a thorough analysis of how Bitcoin halving might affect the Vietnamese market, touching on investment strategies, market behaviors, and the overall growth of cryptocurrency in the region.

The Basics of Bitcoin Halving

Before delving deeper, let’s break down what Bitcoin halving means. Essentially, Bitcoin halving refers to the event that occurs approximately every four years, where the block reward for mining Bitcoin is reduced by 50%. This process is integral to Bitcoin’s monetary policy and helps to control inflation. Here are the key points:

- Effective scarcity: Each halving reduces the number of new Bitcoins created, effectively making them scarcer.

- Price implications: Historically, halvings have led to significant price increases, though market conditions can vary.

- Investor interest: Halvings tend to spark increased interest in Bitcoin and other cryptocurrencies.

In Vietnam, the anticipation surrounding the upcoming halving in 2024 is palpable. With a growing number of cryptocurrency enthusiasts, it’s essential to evaluate the possible outcomes and the effect it might have on local investors.

The Vietnamese Crypto Landscape

According to a report by hibt.com, Vietnam ranks among the top countries in terms of cryptocurrency adoption. In 2023, an estimated 30% of Vietnamese internet users engaged in some form of cryptocurrency trading. This figure represents a dramatic increase from previous years, signaling a serious interest in digital assets. With ongoing crypto education initiatives and an increasing number of local exchanges, the Vietnamese market is uniquely positioned for growth.

Vietnam’s Young Population and Crypto Adoption

Vietnam boasts one of the youngest populations in Southeast Asia, with over 60% of its citizens under the age of 35. This demographic is tech-savvy and open to innovative investment opportunities, making them more likely to adopt cryptocurrencies. Here’s how the characteristics of the Vietnamese market assist in promoting crypto:

- Digital Natives: This group is comfortable with technology and online platforms.

- Economic Motivation: High inflation rates in Vietnam make digital currencies an attractive alternative.

- Remittance Needs: Many Vietnamese work overseas and prefer using cryptocurrencies for remittances.

Given these factors, halving events like the one in 2024 provide a timely opportunity for the younger generation to engage with Bitcoin.

Impact of Bitcoin Halving on Investment Strategies in Vietnam

As the halving approaches, it is crucial to explore how the event could reshape investment strategies for Vietnamese enthusiasts. Here are various aspects to consider:

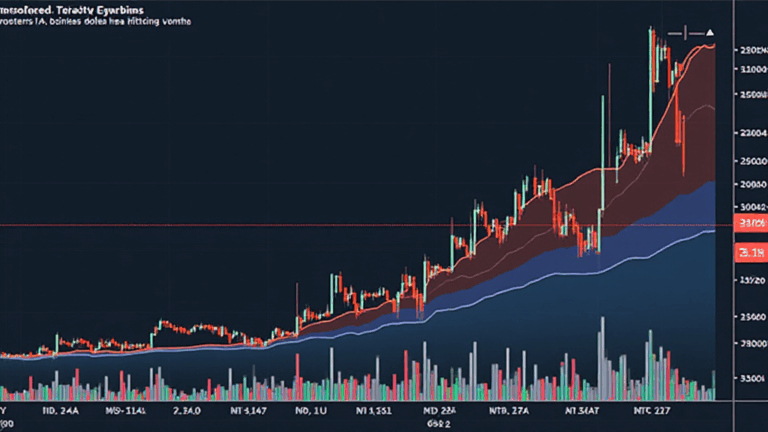

Potential Price Trajectories

Data analysis of past halvings suggests that Bitcoin’s price typically experiences an upward trend post-halving. For instance, the 2020 halving correlated with a price increase of over 400% within a year. Vietnamese investors should be mindful of these historical patterns while making their investment decisions.

Long-term Hold versus Short-term Trading

With fluctuating prices around halving events, strategies diverge significantly. Investors must decide whether to:

- HODL: Many advocate for holding Bitcoin long-term, capitalizing on scarcity.

- Trade Actively: Day trading might benefit those who can monitor market fluctuations continuously.

Increased Interest in Altcoins

An interesting trend emerges during halving periods: increased attention towards altcoins and potential investment in them. Many consider altcoins like Ethereum and Binance Coin when Bitcoin’s value propels. Here’s why:

- Diverse Opportunities: Investors look for viable alternatives to capitalize on prevailing trends.

- Market Momentum: As Bitcoin rises, the overall crypto market often follows suit.

In Vietnam, the interest in altcoins could potentially surface as more local firms introduce innovative projects and digital assets.

Regulatory Environment in Vietnam Around Cryptocurrency

The regulatory landscape surrounding cryptocurrencies in Vietnam is evolving. The government has started recognizing the potential of blockchain technology, and as of 2023, the Ministry of Finance has begun outlining regulations for cryptocurrencies and digital assets. Here are key highlights:

- Legal Framework: Initiatives are underway to establish a formal framework to regulate crypto activities.

- Tax Implications: Vietnamese investors may face taxation on profits—important to consider for long-term strategies.

- Security Standards: As Vietnamese authorities look to enforce tiêu chuẩn an ninh blockchain, it remains crucial for investors to recognize trustworthy platforms.

The direction Vietnam’s regulations take will significantly influence local investment behaviors during and after the upcoming halving.

How to Identify Reliable Investment Platforms

In a rapidly changing market, identifying reliable platforms becomes a key strategy for any investor. Here are practical tips:

- Research Platforms: Investigate exchanges by reviewing user feedback and performance ratings.

- Security Features: Ensure platforms provide robust security standards to protect investments.

- Customer Support: Select platforms that offer reliable and accessible customer service for any inquiries.

As the 2024 Bitcoin halving approaches, understanding these dynamics will play a critical role in smart investing in Vietnam’s crypto market.

The Conclusion: What’s Next for Bitcoin and Vietnam?

To summarize, the upcoming Bitcoin halving presents various investment opportunities and strategies for Vietnamese investors. With a rapidly growing market and a unique demographic poised for digital asset engagement, the potential for significant returns exists.

While the historical context suggests a bullish outlook, factors like market sentiment, regulatory changes, and global economic conditions should also be taken into account. As Vietnamese investors gear up for the halving, keeping informed will be integral to navigating the complexities of this developing landscape. It’s vital to stay ahead of the curve by educating oneself on upcoming trends and data, particularly concerning understanding the local and global impacts of these events.

In essence, the next steps involve not only adaptation but preparedness for what’s to come. Now might just be the perfect opportunity to invest in Bitcoin and other cryptocurrencies as Vietnam continues its journey towards becoming a robust player in the global crypto space.

Lastly, remember that this is not financial advice. Always consult local regulations and market professionals for informed decisions.

Expert Author: Dr. Nguyễn Thị Hằng, a renowned cryptocurrency researcher with over 15 published articles on blockchain technology and market trends, has contributed to several high-profile audit projects within the crypto industry.