Introduction

In the ever-evolving landscape of cryptocurrency trading, the challenge of navigating volatile market conditions is ever-present. As of 2024, it is estimated that over $4.1 billion has been lost to various hacks and liquidations within the DeFi sector alone. This highlights the phenomenal risk involved in cryptocurrency investments, making advanced insights such as liquidation heatmaps crucial for traders.

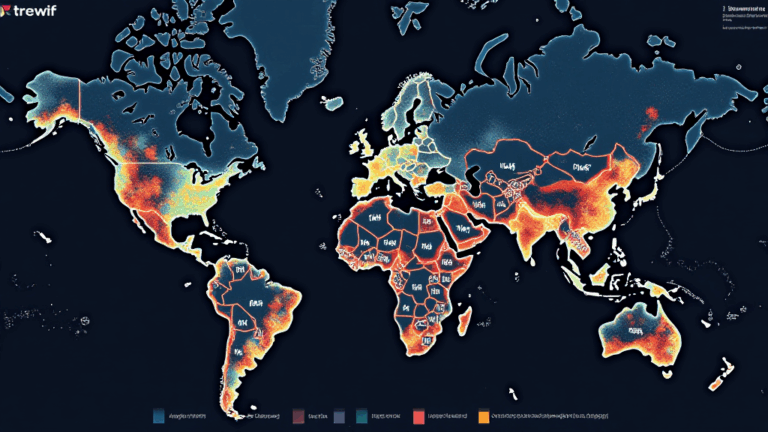

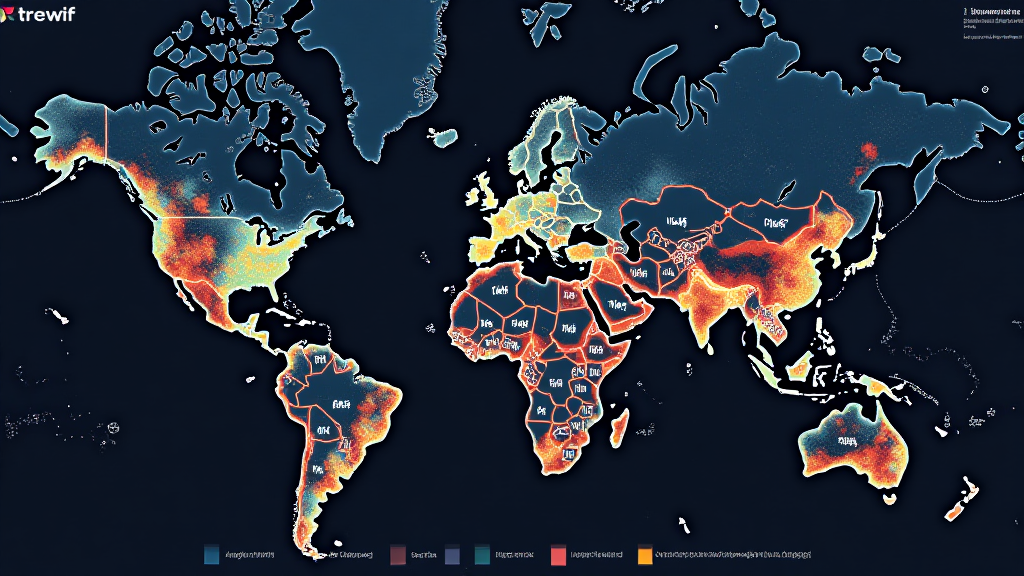

Liquidation heatmaps crypto, leverages real-time data to visualize potential liquidation points in the market. By understanding these heatmaps, investors can make informed decisions, mitigating risks while optimizing their profit potential.

What are Liquidation Heatmaps?

Simply put, liquidation heatmaps are visual tools that display the concentration of leveraged positions on cryptocurrency exchanges. Think of it as a radar for potential liquidation zones.

Just like a bank vault designed to safeguard valuable assets, a liquidation heatmap gives traders critical insights about where significant selling pressure might occur as prices approach certain levels. These hot spots often indicate levels where traders with leveraged positions are at risk of being liquidated, triggering cascading sell-offs in the market.

How Liquidation Heatmaps Work

Liquidation heatmaps aggregate data regarding margin trades within a specific crypto asset. When traders utilize leverage, they essentially borrow funds to amplify their buying or selling positions. However, high leverage also increases the chances of liquidation if the market moves against their positions.

This data is represented visually through a color-coded heatmap, where warm colors (such as red) indicate high concentration liquidation zones, while cooler colors (e.g., blue) represent lower risk areas. This visualization allows traders to anticipate potential market movements associated with liquidation events.

Significance of Liquidation Points in Trading Strategies

ong>Market Sentiment Indicator: ong> Liquidation points can reflect trader sentiment in the market. A high presence of long positions (buying on leverage) can indicate bullish sentiment, while a high concentration of short positions (selling on leverage) often reflects bearish outlooks.ong>Risk Management: ong> By utilizing liquidation heatmaps, traders can better manage risk levels by avoiding or strategically entering positions near tracked liquidation points.ong>Opportunity to Profit: ong> Identifying high-risk zones on the heatmap can present lucrative trading opportunities as prices move towards these concentrated liquidation points.

Understanding the Impact of Local Markets: Focus on Vietnam

As the Vietnamese cryptocurrency market continues to witness remarkable growth, it’s essential to contextualize how liquidation heatmaps fit into this landscape. With a user growth rate estimated above 300% in 2023, Vietnam stands as a significant player in the Asian crypto scene.

Traders in the region can leverage liquidation heatmaps to navigate local market fluctuations, aligning with global trends while capitalizing on local market behaviors.

Utilizing Local Market Data for Strategic Decisions

The price movements within Vietnamese crypto markets can be markedly influenced by local economic conditions, regulations, and investor sentiment. Thus, understanding how liquidation heatmaps function locally can empower traders to make better strategic decisions.

For instance, a sudden governmental regulation can lead to increased liquidation in positions if traders attempt to exit rapidly, causing significant price impact.

Limitations of Liquidation Heatmaps

While extraordinarily useful, it is crucial to recognize that liquidation heatmaps are not infallible. Let’s break down some limitations:

ong>Delayed Data: ong> Depending on the platform, data updates for liquidation points may not be instant.ong>Market Manipulation: ong> The presence of large players can distort the representation of liquidation points.ong>Psychological Factors: ong> Trader psychology plays a key role that sometimes reflects in irrational market behaviors not accurately displayed on the heatmap.

Case Study: Analyzing Liquidation Events

By analyzing past events, traders can identify patterns associated with liquidations. For instance, during a price correction in April 2023, Bitcoin witnessed a liquidation of over $1 billion worth of long positions. Examining the liquidation heatmap leading up to this event revealed a significant concentration in the $45,000 to $50,000 zone, illustrating that many traders were highly leveraged in this range.

This is a prime example of using historical data in conjunction with heatmaps to anticipate and react to future market movements.

Tools for Navigating Liquidation Heatmaps

Several platforms offer liquidity heatmaps, each featuring unique analytical tools. Recommended tools include:

ong>Binance: ong> Offers advanced charting including liquidation visualizations.ong>Deribit: ong> A popular choice among derivatives traders providing real-time liquidation levels.ong>Hibt.com: ong> A useful resource specifically aimed at providing insight into market movements related to liquidations.

Conclusion

In conclusion, understanding and utilizing liquidation heatmaps crypto can provide valuable insights for better trading decisions and risk management. As the world of cryptocurrency continues to evolve, traders must adapt to rapidly changing environments, such as those seen in Vietnam’s booming market. Incorporating insights from liquidation trends can lead to enhanced trading strategies and improved profitability. For anyone looking to delve further into the complexities of crypto trading, embracing advanced tools like liquidation heatmaps is not merely useful; it’s essential.

Notably, always remember that while these tools can provide guidance, prudent judgment and thorough research should accompany trading decisions. For more resources on crypto investments and strategies, visit topbitcoinwallet.

About the Author

Dr. Nikolai Tran is a seasoned blockchain analyst specializing in trading strategies and risk management. With over 15 published papers in the fields of blockchain technology and market analysis, he also led several significant crypto auditing projects.