Introduction: DeFi Growth in Southeast Asia

As we step into 2025, the financial landscape of Southeast Asia is undergoing a radical transformation. With an estimated

This article delves into the rapid DeFi growth in Southeast Asia, exploring key factors contributing to this trend, the challenges faced by the market, and future opportunities for investors. Understanding these dynamics is paramount for leveraging this burgeoning sector effectively.

The Appeal of Decentralized Finance

DeFi, short for decentralized finance, leverages blockchain technology to provide financial services without traditional intermediaries like banks. This approach democratizes access to financial products and services. In Southeast Asia, where a large population remains unbanked (

Why Southeast Asia?

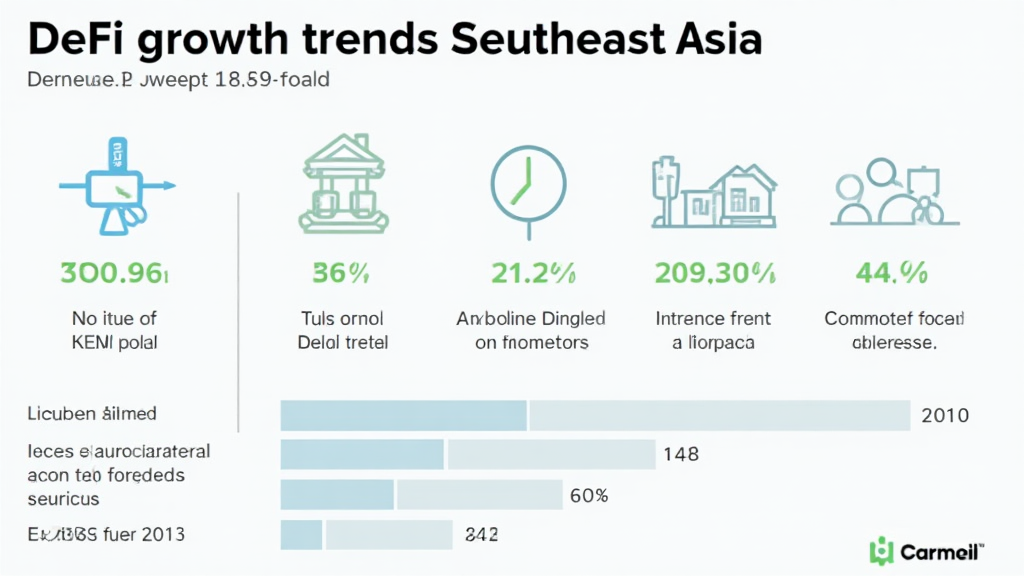

ong>High Mobile Penetration: ong> Overong>80% ong> of the Southeast Asian population owns a smartphone, providing an accessible gateway to digital finance.ong>Youthful Population: ong> The average age across the region is underong>30 years ong>, a demographic that is more tech-savvy and open to adopting new financial technologies.ong>Growing Internet Accessibility: ong> With aong>300% ong> increase in internet users since 2010, the potential for online financial services is immense.

Investment Opportunities in DeFi

Investors in Southeast Asia are increasingly turning to DeFi as a source of yield. Many platforms offer high Annual Percentage Yields (APYs) that traditional banks cannot provide. For instance, certain DeFi protocols offer APYs that exceed

Moreover, with initiatives like central bank digital currencies (CBDCs) in the pipeline, the push toward digital finance is only expected to accelerate. While these developments present opportunities, they also bring forth the need for robust risk management.

Challenges in DeFi Adoption

Regulatory Landscape

Despite the promising outlook, the regulatory environment in Southeast Asia remains fragmented. Countries such as Vietnam and Thailand are making strides in regulating cryptocurrency and DeFi, but inconsistencies persist. Investors must navigate a patchwork of regulations that can impact their investments.

“Not financial advice. Consult local regulators.” This is an essential reminder in consideration of the legal complexities surrounding DeFi in various jurisdictions.

Security Risks

Security is another major concern for DeFi investors. According to recent reports, approximately

For instance, platforms must conduct regular audits, which brings to light the significance of understanding các tiêu chuẩn an ninh blockchain.

The Future of DeFi in Southeast Asia

Looking ahead, the future of DeFi in Southeast Asia seems bright, albeit with caution. As more users familiarize themselves with decentralized applications (dApps), there will be an increase in demand for improved interfaces and user education.

Moreover, the trend of integrating traditional finance with DeFi is expected to continue. Innovations like decentralized insurance, lending, and staking will play critical roles in the evolving ecosystem.

Conclusion: Embracing DeFi Growth in Southeast Asia

As we assess the DeFi landscape in Southeast Asia, it’s clear that the potential for economic evolution is enormous. With emerging technologies and increasing investor interest, the region is on the brink of a financial revolution.

In conclusion, while there are hurdles to overcome—ranging from regulatory issues to security concerns—the opportunities within DeFi remain vast. To tap into this potential, stakeholders must prioritize security, educate investors, and remain adaptable to the shifting regulatory environments.

Remember, being informed and cautious about the DeFi world is key. If you are interested in exploring further, check out our insights on hibt.com. For those looking to get a foothold in this evolving market, understanding the precise dynamics of

Meet Our Expert

Dr. Nguyen Pham, a renowned blockchain researcher with over