Introduction

\n

In the ever-evolving landscape of cryptocurrency trading, where $4.1 billion was lost to DeFi hacks in 2024 alone, traders are continuously seeking methodologies that can aid in making informed decisions. One such powerful tool in their arsenal is the Fibonacci retracement. This article will delve into the principles and applications of Fibonacci retracement crypto, enriching your understanding and enhancing your trading strategies.

\n\n

What is Fibonacci Retracement?

\n

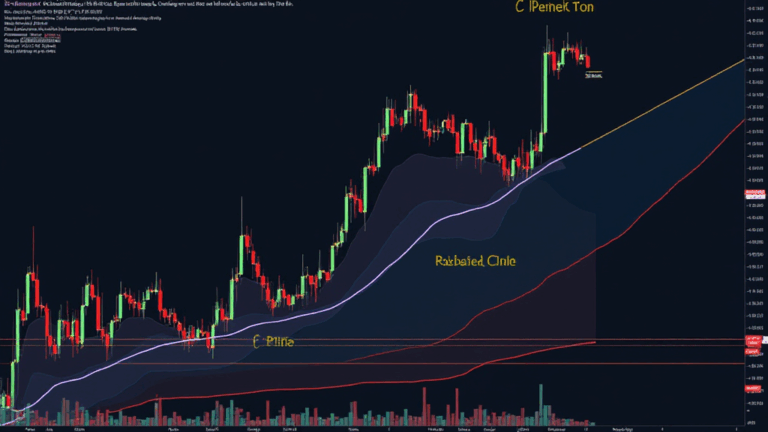

Fibonacci retracement is a technical analysis tool that utilizes the Fibonacci sequence—a mathematical series where each number is the sum of the two preceding ones, often leading to ratios that traders use to predict potential support and resistance levels. These levels can be crucial in determining where the price of a cryptocurrency might reverse or consolidate.

\n\n

- \n

ong>Key Fibonacci Levels: ong> 23.6%, 38.2%, 50%, 61.8%, and 100%ong>Application: ong> Used to identify potential reversal areas in trending markets.

\n

\n

\n\n

The Psychology Behind Fibonacci Retracement

\n

Traders often make decisions based on psychological factors, leading to predictable price movements. By employing Fibonacci levels, traders essentially tap into the collective psychology of the market, anticipating how others might react at certain price points. It’s akin to a crowd gathering at a popular event—certain areas become hotspots for activity based on previous behaviors.

\n\n

\n\n

Real-World Example

\n

Imagine a cryptocurrency that has surged significantly. When it starts to retrace, many traders look at the Fibonacci levels to set buy orders. If the price retraces to the 61.8% level and then shows signs of support, it’s likely that a significant number of traders will buy at this level, reaffirming it as a potential bounce point.

\n\n

How to Use Fibonacci Retracement in Crypto Trading

\n

Using the Fibonacci tool is relatively straightforward, yet it requires practice to master. Here’s a step-by-step guide on implementing Fibonacci retracement:

\n\n

- \n

ong>Identify a Trend: ong> Always start by identifying a clear uptrend or downtrend.ong>Select the Fibonacci Tool: ong> Most trading platforms come equipped with this tool; select the recent swing high and low.ong>Monitor Key Levels: ong> After setting the Fibonacci levels, monitor how the price reacts at critical points (23.6%, 38.2%, etc.).ong>Make Informed Decisions: ong> Consider placing buy/sell orders at these levels based on additional indicators.

\n

\n

\n

\n

\n\n

Limitations of Fibonacci Retracement

\n

While Fibonacci retracement is a valuable tool, it is important to be aware of its limitations.

\n\n

- \n

ong>Subjectivity: ong> Different traders may identify different levels based on their selected highs/lows.ong>No Guarantees: ong> Just because a Fibonacci level has been a support/resistance does not guarantee it will work again.

\n

\n

\n\n

Combining with Other Indicators

\n

To enhance the reliability of signals generated by Fibonacci retracement, traders often combine it with other indicators such as:

\n\n

- \n

ong>Moving Averages: ong> To gauge the overall trend direction.ong>Volume Analysis: ong> To confirm price movements at Fibonacci levels.ong>Relative Strength Index (RSI): ong> To identify overbought or oversold conditions.

\n

\n

\n

\n\n

Fibonacci Retracement and the Vietnamese Crypto Market

\n

The Vietnamese cryptocurrency market has witnessed a remarkable growth rate, with local exchanges booming and increasing the number of active users. According to recent reports, user growth in Vietnam’s crypto sector has risen by approximately 35% year-over-year. This surge indicates a growing interest in trading strategies like Fibonacci retracement in enhancing trading decisions.

\n\n

Localized Trading Strategies

\n

Traders in Vietnam are urged to adapt Fibonacci strategies to local market conditions, taking into account

\n

- \n

- The general volatility of cryptocurrencies.

- Specific regulatory conditions surrounding crypto in Vietnam.

\n

\n

\n\n

Conclusion

\n

In conclusion, Fibonacci retracement techniques can significantly elevate the trading strategies of both novice and experienced traders in the cryptocurrency market. By understanding and applying these principles to market analysis, traders can enhance their ability to forecast price movements. Like a bank vault for digital assets, Fibonacci retracement offers insights into potential support and resistance levels, creating opportunities for well-timed trades. As we have discussed, while it is a strong tool, it should be employed in conjunction with other indicators to increase accuracy.

\n

For anyone looking to delve deeper into crypto trading, understanding the nuances of tools like Fibonacci retracement is invaluable. Access comprehensive guides and insights from topbitcoinwallet today!

\n