Decoding DAO Governance Models in Cryptocurrency

As the decentralized finance (DeFi) landscape continues to evolve, decentralized autonomous organizations (DAOs) are emerging as crucial players in the governance of digital assets. With over $4.1 billion lost to hacks in DeFi in 2024 alone, the need for robust governance models has never been more urgent. This article aims to break down DAO governance models, their significance in the cryptocurrency ecosystem, and how they can help pave the way for a more secure and efficient digital economy.

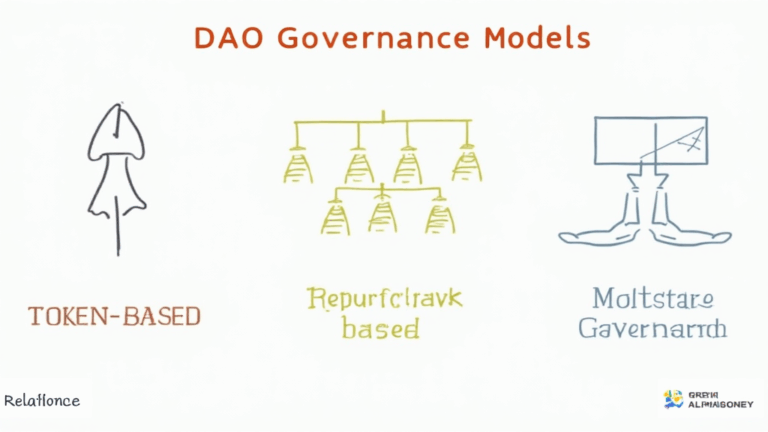

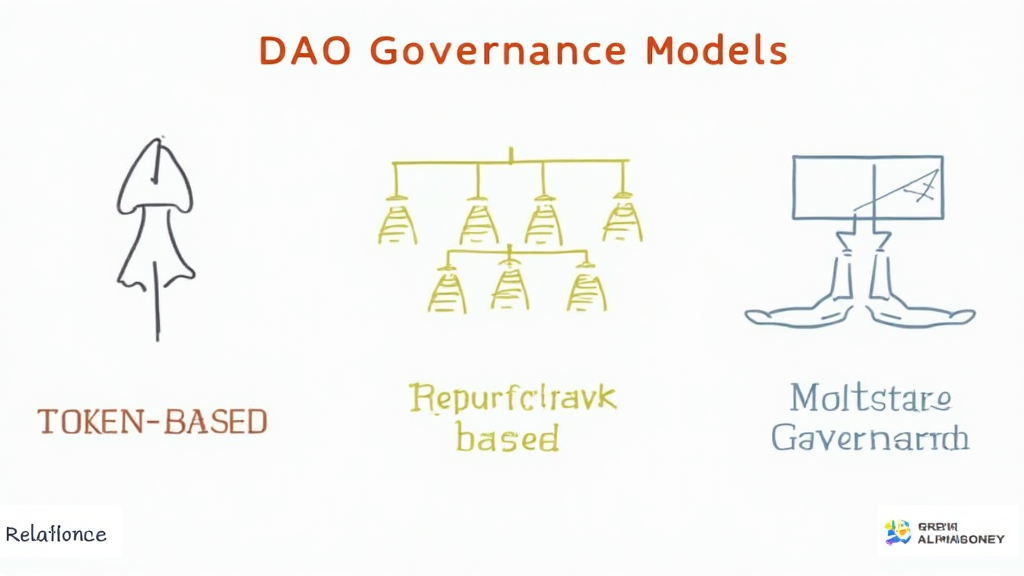

What are DAO Governance Models?

DAO governance models are frameworks that dictate how a DAO operates and makes decisions. Unlike traditional organizations that rely on hierarchical structures, DAOs leverage blockchain technology to enable decentralized decision-making among their members. Here’s a closer look at how these models function:

ong>Token-based Governance: ong> Members hold tokens that grant them voting rights, making it possible for stakeholders to vote on proposals directly.ong>Reputation-based Governance: ong> This model prioritizes members based on their contributions and reputation, allowing those with higher standings to have greater voting power.ong>Multi-Signature Governance: ong> It requires multiple parties to validate any changes, enhancing security via collective agreement.

Historical Context of DAOs

The concept of DAOs gained traction with the rise of Ethereum, the blockchain that supports smart contracts, enabling complex governance structures to be created. This innovation has changed the way investors and communities engage with projects. A prominent example was The DAO, which raised over $150 million in 2016 before suffering a significant hack. Even with its failure, this incident paved the way for improved security measures and governance protocols in the industry.

Why are DAO Governance Models Important?

DAOs promote community engagement and transparency, essential factors in fostering trust within the crypto ecosystem. Here’s how they contribute:

ong>Decentralization: ong> Eliminates single points of failure, mitigating risks associated with centralized governance.ong>Inclusivity: ong> Every token holder has a voice, allowing a true representation of community interests.ong>Flexibility: ong> Governance proposals can rapidly adapt to changing circumstances in the market or community needs.

Challenges in DAO Governance

While DAOs offer numerous benefits, they are not without challenges. Issues such as low voter turnout, potential concentration of power, and governance manipulation persist. For instance, in a 2025 survey of Ethereum-based DAOs, it was found that

Key Elements of Effective DAO Governance Models

To ensure that DAO governance is effective, several elements need to be considered:

ong>Clear Protocols: ong> Establishing clear guidelines for decision-making processes is fundamental.ong>Incentives for Participation: ong> Offering rewards for active participation can help increase engagement rates.ong>Regular Evaluations: ong> Periodically reviewing and adapting governance structures ensures they remain relevant and effective.

Examples of Successful DAO Governance Models

Several DAOs have successfully navigated the complexities of governance, offering insight into effective practices:

ong>MakerDAO: ong> Utilizes a token-based governance system where MKR holders vote on critical protocol changes, providing a balanced approach to decision-making.ong>Aragon: ong> Allows users to create their own DAOs and tailor governance systems that fit their unique needs. Its flexibility fosters innovation across communities.ong>Yearn Finance: ong> Operates with a DAO model where community members are incentivized to propose improvements, driving continual progress.

Future Trends in DAO Governance Models

As the cryptocurrency market matures, several trends are emerging within DAO governance that could shape the future:

ong>Enhanced Integration with Traditional Finance: ong> More DAOs are exploring partnerships with traditional financial entities, requiring transparent governance structures.ong>Regulatory Compliance: ong> As authorities develop frameworks around blockchain technologies, DAOs will need to adopt compliance mechanisms to ensure legitimacy.ong>Sophisticated Voting Mechanisms: ong> Advanced on-chain governance tools are being developed, allowing for dynamic voting that can adapt based on real-time data.

The Role of Vietnamese Users in DAO Evolution

The Vietnam crypto market has been rapidly expanding, with a user growth rate of over

Conclusion: Building the Future of DAO Governance

DAO governance models are integral to the future of decentralized finance, fostering transparency, community involvement, and adaptability. With the ongoing evolution of blockchain technology and a focus on community engagement, we can anticipate more innovative governance frameworks that cater to the needs of users worldwide. As we move forward, stakeholders should prioritize modeling which enhances security and fosters active participation. Each advancement in DAO governance takes us one step closer to a more democratized financial ecosystem.

To dive deeper into the world of DAOs and explore various topics in cryptocurrency, visit topbitcoinwallet.