Candlestick Patterns in Crypto Trading 2025

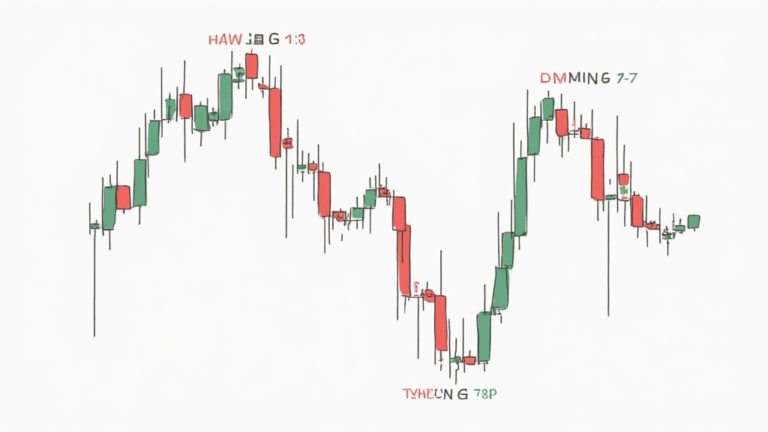

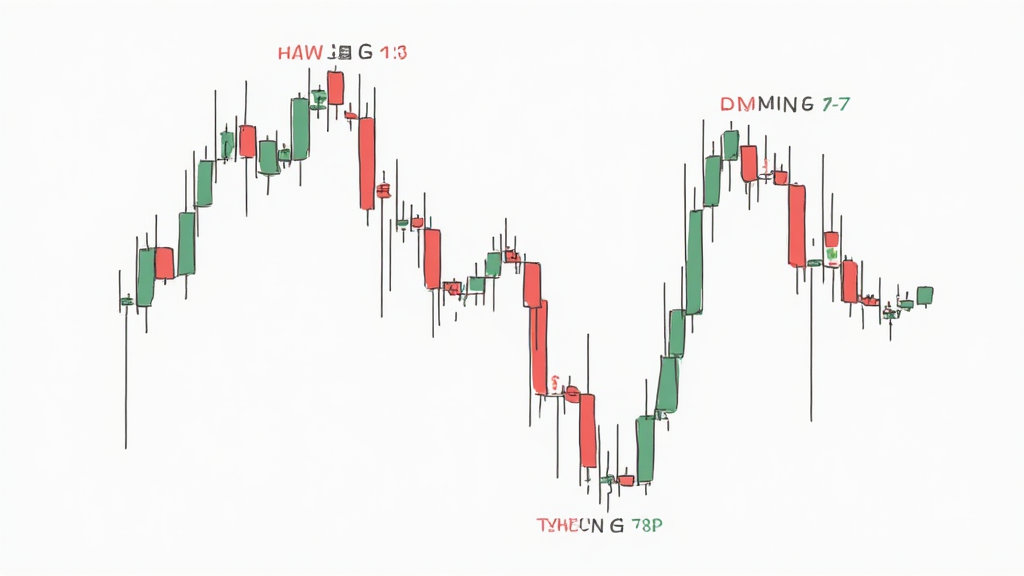

As we look towards the future of crypto trading, understanding various candlestick patterns becomes increasingly vital. With significant market fluctuations, traders must equip themselves with reliable analysis tools.

Why Candlestick Patterns Matter

In the world of cryptocurrency, price movement is fast and unpredictable. According to market data, over $4.1 billion was lost in hacks and scams in 2024, stressing the need for reliable trading techniques. One of the most effective methods for analysis is candlestick patterns. These patterns provide visual representations of price movements over specific time frames, allowing traders to make informed decisions.

Identifying Key Candlestick Patterns

Let’s break down some of the essential candlestick patterns that traders should watch for in 2025.

- Doji: Indicates market indecision and often signals a reversal. Look for it after a strong trend.

- Hammer: A bullish reversal indicator, usually found at the bottom of a downtrend.

- Shooting Star: A bearish reversal pattern that appears at the top of an uptrend.

- Engulfing Patterns: These signify strong reversals, either bullish or bearish, based on the prior candlesticks.

Applying Patterns in 2025

Using these patterns effectively involves more than just recognizing them. Traders should consider market context, including news, sentiment, and overall trends. A good practice is to combine candlestick analysis with other tools, such as technical indicators.

Utilizing Support and Resistance Levels

Support and resistance lines enhance the effectiveness of candlestick analysis. For instance, if you spot a bullish engulfing pattern near a support line, the likelihood of a price increase increases significantly.

Vietnam Market Insights

As we explore candlestick patterns, let’s consider the Vietnamese market. With an annual user growth rate of over 30%, Vietnam is quickly becoming a hotspot for cryptocurrency trading. Implementing sound trading strategies, including candlestick analysis, is crucial for both novice and experienced traders in this rapidly evolving landscape.

Risk Management Strategies

While understanding candlestick patterns is essential, managing risks is just as critical. Use stop-loss orders effectively to protect your investments and mitigate potential losses. Always remember that trading cryptocurrencies comes with inherent risks.

Final Thoughts on Candlestick Patterns for 2025

To conclude, mastering candlestick patterns is a strategic advantage for crypto traders in 2025. Keeping an eye on market dynamics and incorporating data-driven insights will significantly enhance trading prowess. As you advance in your trading journey, consider trusted platforms such as topbitcoinwallet for secure transactions and valuable market insights.

Stay informed, stay safe, and happy trading!

Author: Dr. Alex Nguyen, a financial analyst with over 15 published papers on cryptocurrency trading strategies and risk management, and a leading expert in blockchain technology audits.