Maximizing Extractable Value: Understanding MEV in Blockchain

In the world of blockchain and digital assets, maximizing extractable value (MEV) is a topic gaining significant attention. With more than $4.1 billion lost to DeFi hacks in 2024 alone, understanding MEV is not just a technical necessity but also a financial imperative for users and investors. This article aims to demystify MEV, its implications, and strategies to optimize its potential within your crypto assets.

What is Maximizing Extractable Value (MEV)?

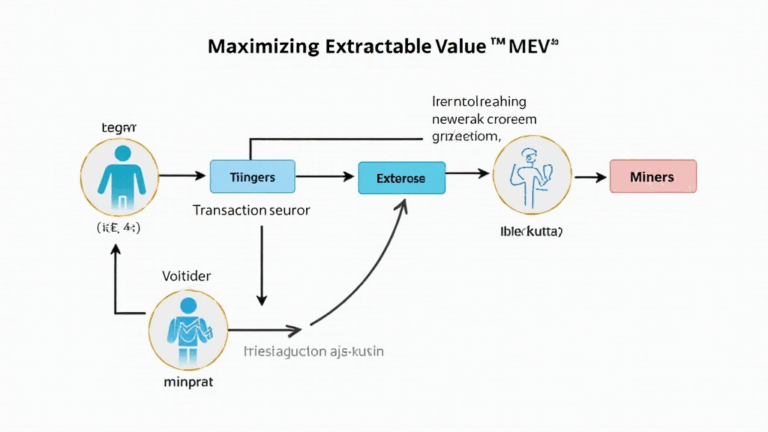

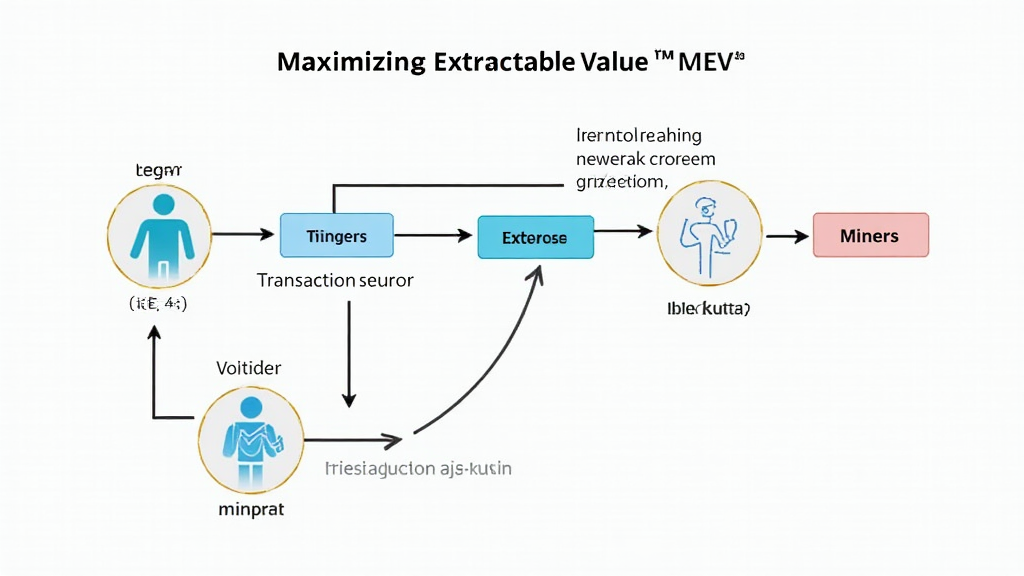

Maximizing Extractable Value, often abbreviated as MEV, refers to the additional profit that miners or validators can earn from the reordering, inclusion, or exclusion of transactions within a block. This relates closely to how decentralized finance (DeFi) protocols function and can significantly impact transaction outcomes.

Think of it like this: if a bank could reorder its clients’ transactions to maximize profit, it would. Similarly, miners can strategically manage transactions to their advantage in the blockchain ecosystem.

The Mechanics of MEV

MEV is influenced by various factors, including transaction fees, user behavior, and market movements. The two primary forms of MEV are:

ong>Arbitrage Opportunities ong>: Miners can capitalize on price discrepancies across different exchanges.ong>Liquidation Opportunities ong>: If a user’s collateral falls below a certain threshold, miners can liquidate positions for profit.

How is MEV Extracted?

The extraction of MEV occurs through various mechanisms, such as:

ong>Front-running ong>: This involves placing a transaction before a pending transaction to profit from the anticipated price change.ong>Back-running ong>: In contrast, this tactic executes a transaction right after another, usually capitalizing on price fluctuations.

For instance, if you notice a large buy order for an asset, a miner can execute their buy order first, causing the price to surge before the larger buy is executed, allowing the miner to sell at a profit.

Impact of MEV on Users

MEV primarily affects users by increasing transaction costs and creating volatility. High levels of MEV extraction can lead to:

ong>Higher Gas Fees ong>: Users must compete against miners willing to pay more to ensure their transactions are prioritized, increasing overall costs.ong>Market Inefficiencies ong>: As miners profit from reordering transactions, it can lead to unpredictable market behavior, resulting in potential losses for unsuspecting users.

Real-World Examples of MEV

One of the most notable examples of MEV occurred during the launch of popular DeFi tokens. Traders racing to buy these tokens at the launch price often faced inflated gas fees due to front-running activities from miners. Arguably, this injustice undermines the decentralized ethos of the blockchain, creating barriers for the average investor.

Strategies for Minimizing MEV Risks

While it’s challenging to eliminate MEV risks completely, certain strategies can help minimize its impact:

ong>Transaction Bundles ong>: Users can combine multiple transactions into a single bundle to reduce visibility, thereby mitigating front-running risks.ong>Using Private Transactions ong>: Services like Flashbots offer private transaction options that help shield users from opportunistic miners.

Recommended Tools and Platforms

In your pursuit of minimizing MEV, consider using tools like:

ong>Flashbots ong>: A research and development organization focused on alleviating the negative externalities of MEV.ong>MMR (Miner Managed Reserved) ong>: Helps in transaction management to avoid public disclosures that can lead to MEV extraction.

Future of MEV and Blockchain

The landscape of MEV is constantly evolving. Regulatory bodies, developers, and the community are becoming aware of the implications of MEV on market fairness. Innovations aimed at reducing or managing MEV are likely to gain traction in the coming years.

For example, the implementation of protocols like

Local Insights: MEV in Vietnam

Vietnam has seen significant growth in cryptocurrency adoption, with the number of users increasing by an impressive

Local platforms must adapt to these changes by implementing better transaction strategies to protect users from high MEV risks, ensuring sustainable growth in the emerging crypto economy.

Conclusion: Navigating the MEV Landscape

Maximizing Extractable Value is a complex phenomenon that can yield high rewards for miners but poses risks for average users navigating the cryptocurrency space. By leveraging the recommended strategies and tools, users can mitigate risks while still participating in the blockchain ecosystem.

As a responsible investor, it’s paramount to understand MEV, whether you’re an experienced trader or a newcomer eager to explore the advantages of blockchain technology. Remember, knowledge is your best ally in this venture.

For more insightful resources, consider exploring platforms like topbitcoinwallet, where you can further educate yourself about the evolving landscape of cryptocurrencies.

Author: Dr. Vincent Tran — A blockchain researcher with over 20 published papers in the field and the lead auditor for several known digital asset projects.