The Significance of Bitcoin Halving

Throughout its history, Bitcoin has undergone several halving events, the first of which was in 2012. Each halving occurs approximately every four years, reducing the reward miners receive for adding new blocks to the blockchain by half. This mechanism is central to Bitcoin’s supply schedule, capping the total number of Bitcoins that will ever exist at 21 million. Given the dramatic rise in Bitcoin’s price following previous halving events, many investors and enthusiasts have pondered the implications of such events on the long-term sustainability and price stability of Bitcoin.

The Mechanics of Halving

At its core, Bitcoin halving is designed to control inflation. By systematically reducing the supply of new Bitcoins, the protocol aims to increase scarcity. For example, in 2020, the block reward decreased from 12.5 BTC to 6.25 BTC. This reduction is significant, as it will be halved again in 2024, dropping to 3.125 BTC. Such changes raise the question: how does this scarcity affect price?

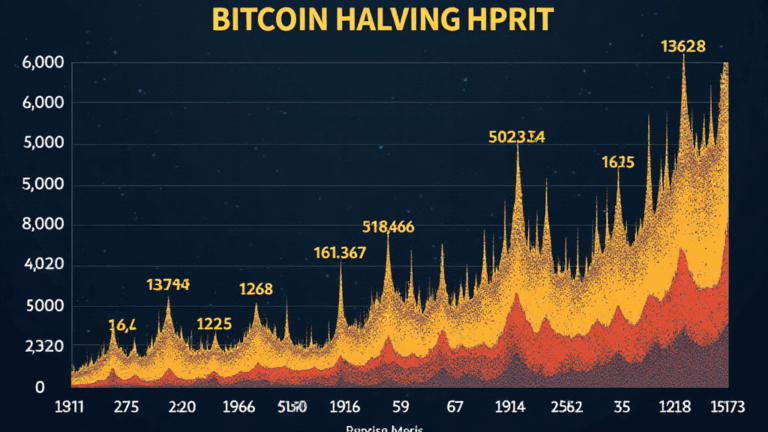

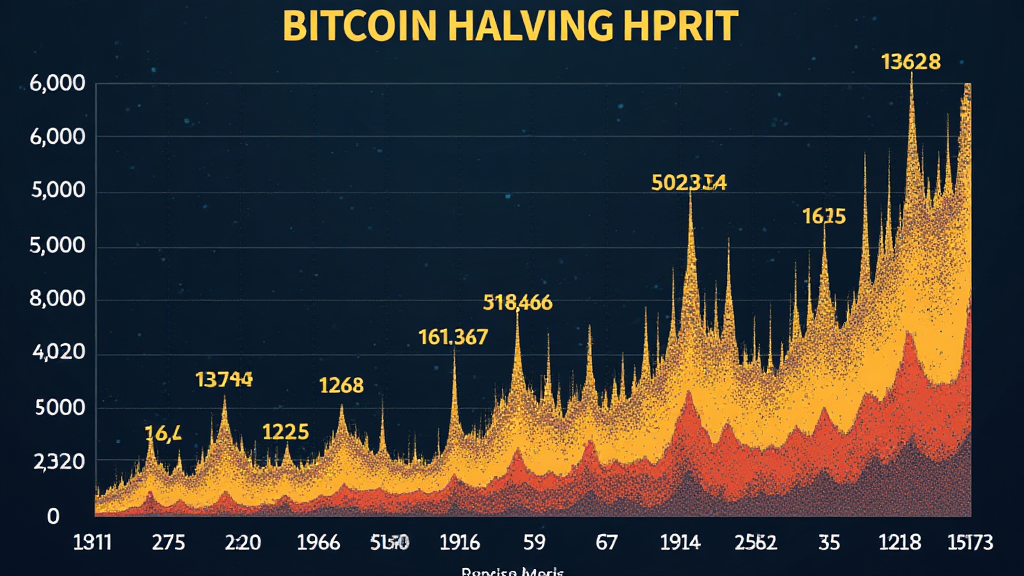

Historical Price Movements Post-Halving

Historically, Bitcoin’s price has shown a tendency to rise in the months and years following a halving event. For instance, after the 2016 halving, Bitcoin’s price surged from around $450 to nearly $20,000 by the end of 2017. Similarly, following the 2020 halving, prices climbed to an all-time high of over $60,000 in 2021. This pattern is often attributed to increased demand amidst decreasing supply, flipping the basic economics of the market.

Analyzing Past Trends

ong>2012 Halving: ong> Price increase from $12 to $1,200 over the subsequent year.ong>2016 Halving: ong> Price increment from $650 to near $20,000 within 18 months.ong>2020 Halving: ong> Price escalation from $8,000 to over $60,000 by 2021.

Using these past events as a benchmark, it’s essential to consider the unique factors influencing the upcoming halving in 2024. Geopolitical dynamics, government regulations, and advancements in technology could all play significant roles that deviate from historical trends.

Long-Term Impact of Bitcoin Halving on Market Dynamics

As we move toward the next halving in 2024, it is crucial to explore the broader implications that these events have on the overall market dynamics.

Market Sentiment and Speculation

- Prior to halving events, market sentiment historically becomes bullish, leading to speculative trading that can inflame price movements.

- As accumulation accelerates, long-term holders (HODLers) may begin to withdraw their assets from exchanges, decreasing available liquidity.

The Potential for Institutional Investment

With increasing awareness and acceptance of Bitcoin by institutional investors, the long-term outlook for Bitcoin becomes increasingly positive following a halving. Institutions often enter the market in anticipation of price increases, which can solidify the bullish trends observed post-halving.

Global Adoption and Its Influence on Bitcoin

As the cryptocurrency landscape continues to evolve, global adoption plays a significant role in shaping Bitcoin’s future post-halving.

Emerging Markets and User Growth

Particularly in markets like Vietnam, where the user growth rate for cryptocurrencies has skyrocketed by over 700% in the past two years, new investors are entering the market nearly every day. The local market’s embrace of Bitcoin solidifies its position as a digital asset, further exacerbating the effects of scarcity induced by halving.

Localization of Influences

As the market continues to expand, local factors, including regulations and investor sentiment, will inevitably influence Bitcoin’s price dynamics. For instance, Vietnam’s burgeoning interest in blockchain-based technologies highlights a growing acceptance that will subsequently affect Bitcoin’s market.

Conclusion: The Road Ahead After the Bitcoin Halving

In summary, while historical data provides valuable insights into the impact of Bitcoin halving, various external factors will contribute to its future trajectory. As the market adopts these principles, potential volatility increases but ultimately yields opportunities for long-term investors. Whether you’re an established investor or just entering the world of cryptocurrency, understanding the implications of halving can guide you through the coming years.

As always, remember that investing in cryptocurrencies involves substantial risks. Seek advice from financial advisors and local regulators if you’re considering investing in this specialized market. Not financial advice; consult with local regulations to understand your rights and obligations.

For further resources, please visit hibt.com for more insights into crypto regulations and investment opportunities.

It will be fascinating to watch how global dynamics meld with the mechanics of Bitcoin halving. The next halving event in 2024 could be pivotal not only for its price but for the broader acceptance of cryptocurrencies worldwide.